Tax Rates

Below you will find information on where tax monies go in Nixa. Each section provides a break down as well as a pie chart. If you need further information, feel free to contact the Nixa Finance Department at 724-5625.

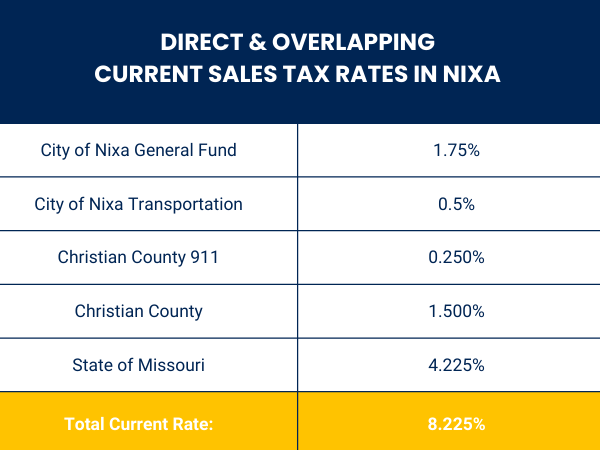

Sales Tax

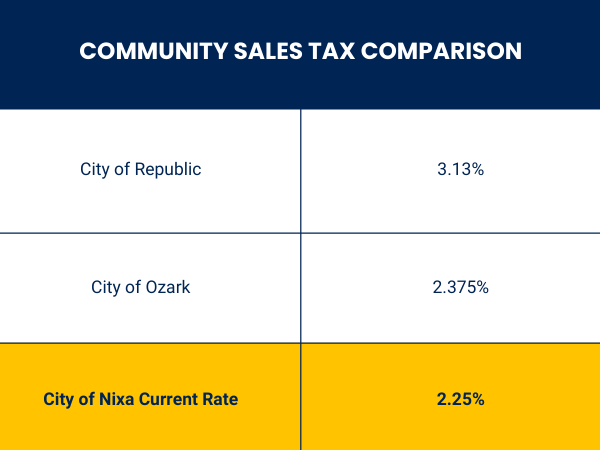

The City of Nixa collects 2.25% sales tax. This is composed of a 1.75 cent general sales tax (.75 of which is committed to police department purposes) and a dedicated .5 (half-cent) transportation tax which is dedicated only to street department purposes.

Christian County collects a 1.5% sales tax.

Christian County 911 collects a .25% sales tax.

The State of Missouri collects 4.225% sales tax.

Total Direct & Overlapping Sales Tax Rate: 8.225%

Property Tax

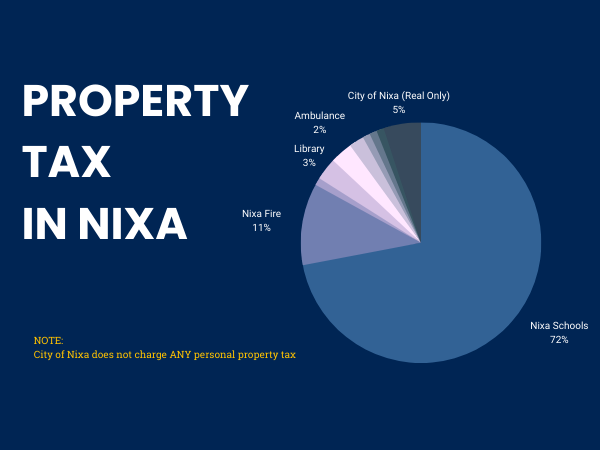

The City of Nixa receives 5% of the total property tax collected from Nixa property owners. The City of Nixa does not collect any personal property tax, and has not since 1987.

| Property Tax Rates | 2020 | 2019 | 2018 | 2017 | 2016 |

| City of Nixa (Real Only) | 0.3246 | 0.3246 | 0.3286 | 0.3286 | 0.3316 |

| Nixa Schools | 4.7000 | 4.7000 | 4.2896 | 4.2876 | 4.2875 |

| Nixa Fire District | 0.7291 | 0.7291 | 0.7338 | 0.7338 | 0.7339 |

| State of Missouri | 0.0300 | 0.0300 | 0.0300 | 0.0300 | 0.0300 |

| County of Christian | 0.0664 | 0.0540 | 0.0620 | 0.0557 | 0.0715 |

| Library | 0.2009 | 0.2009 | 0.2150 | 0.2009 | 0.0887 |

| Junior College | 0.1996 | 0.1990 | 0.2023 | 0.1498 | 0.1500 |

| Ambulance | 0.1311 | 0.1311 | 0.1324 | 0.1324 | 0.1324 |

| Senate Bill 40 Board | 0.0790 | 0.0790 | 0.0799 | 0.0799 | 0.0799 |

| Health | 0.0439 | 0.0439 | 0.0444 | 0.0444 | 0.0444 |

| Senior Citizens | 0.0495 | 0.0495 | 0.0550 | 0.0550 | 0.0500 |

| Total District Overlapping | 6.5541 | 6.5411 | 6.1680 | 6.0931 | 5.9999 |

Notice of Existence of Use Tax; Use Tax Rate; Applicability; And Rate Modification Requirement as required by CCS for HCS for SS for SCS for SB Nos. 153 & 97

The City of Nixa, Missouri previously adopted and has in force a use tax. The use tax rate for the City is currently 1.5% percent which is equal to the total local sales tax rate. The use tax applies to and impacts certain purchases from out-of-state vendors. A use tax is the equivalent of a sales tax on purchases made from out-of-state sellers by in-state buyers and on certain taxable business transactions.

The use tax rate is equal to the total local sales tax rate in effect in the City. If any local sales tax is repealed or the rate thereof is reduced or raised by voter approval, the local use tax rate shall also be deemed to be repealed, reduced, or raised by the same action repealing, reducing, or raising the local sales tax.

I, Cindy Robbins, City Clerk for the City of Nixa, Missouri, do hereby certify that the foregoing is, to the best of my knowledge and belief, correct. Dated this 7th day of October 2021.

NOTE: In April, 2023, the qualified voters in the City of Nixa approved a general sales tax increase of .75%. This brought the general sales tax rate up to 2.25% and therefore the use tax rate is also raised to 2.25%.